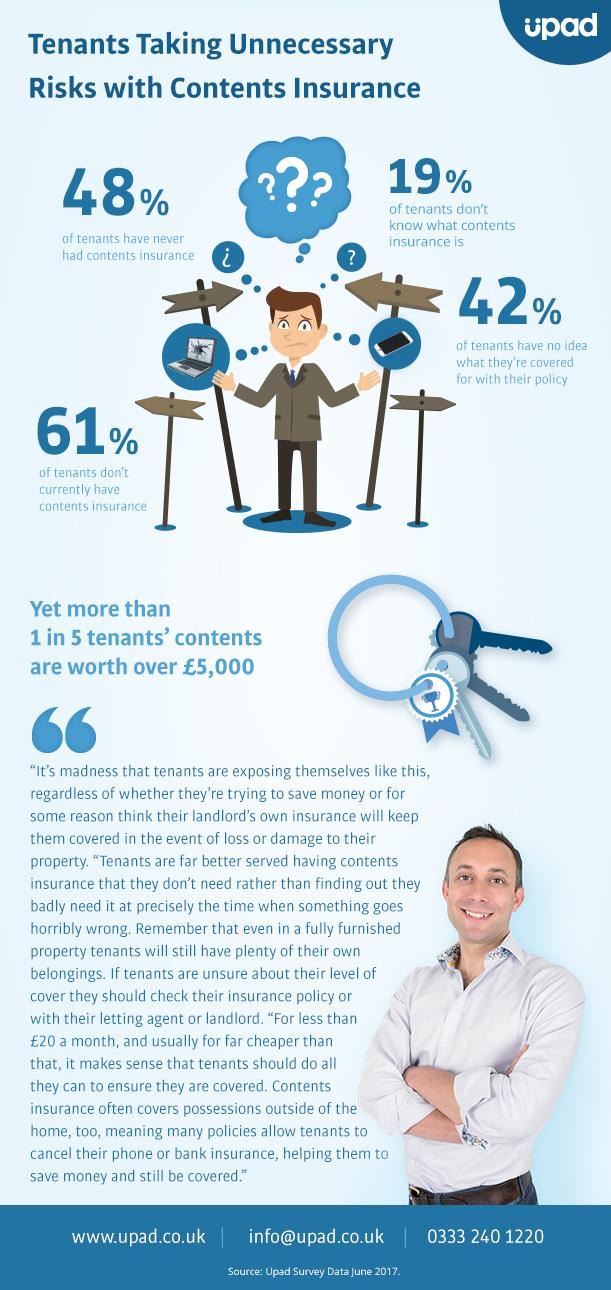

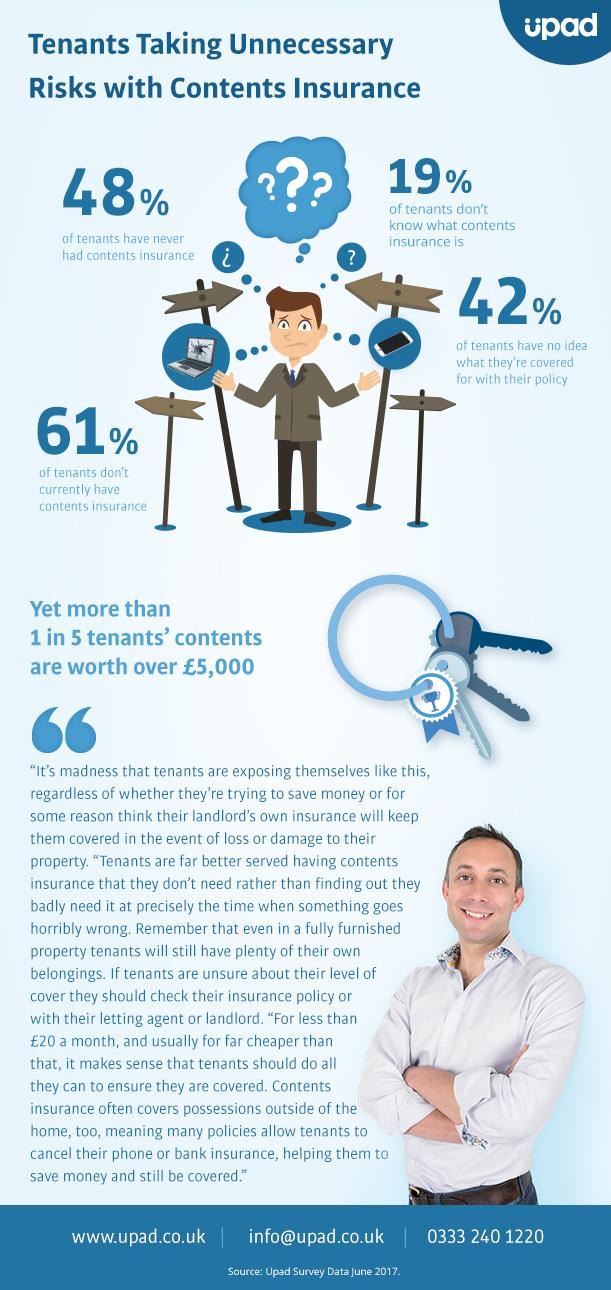

Tenants Taking Unnecessary Risks with Contents Insurance

New tenant research, conducted by leading online letting agent Upad, has discovered that a shocking 61% of tenants currently don’t have any contents insurance, with 48% admitting that they’ve never taken out contents insurance at a property they have lived in.

19% of tenants said they had no idea what contents insurance was, while among those who did have a contents insurance policy, 42% didn’t know what it covered or what to do in the event of needing to make a claim.

These figures are brought further into focus by the final discoveries of the Upad research, which show that 78% of tenants have belongings that value more than £1,000, with 22% having belongings at home with an aggregate value of over £5,000.

Overall Upad discovered:

- 61% of tenants currently do not have contents insurance

- 48% of tenants have never had contents insurance

- 42% of tenants with contents insurance don’t know what their covered for

- 19% of tenants don’t even know what contents insurance is

- More than 1 in 5 tenants have belongings with a combined worth of over £5,000, while almost 4 in 5 have belongings worth at least £1,000.

Upad founder James Davis, himself a portfolio landlord, commented, ““It’s madness that tenants are exposing themselves like this, regardless of whether they’re trying to save money or for some reason think their landlord’s own insurance will keep them covered in the event of loss or damage to their property.

“Tenants are far better served having contents insurance that they don’t need rather than finding out they badly need it at precisely the time when something goes horribly wrong. Remember that even in a fully furnished property tenants will still have plenty of their own belongings. If tenants are unsure about their level of cover they should check their insurance policy or with their letting agent or landlord.

“For less than £20 a month, and usually for far cheaper than that, it makes sense that tenants should do all they can to ensure they are covered. Contents insurance often covers possessions outside of the home, too, meaning many policies allow tenants to cancel their phone or bank insurance, helping them to save money and still be covered.”