The Ultimate Guide to Buy to Let

Despite the UK Government continuing to introduce policies aimed at making it difficult for buy-to-let landlords to make significant profits, buy-to-let is still an attractive investment opportunity for anyone that is able to purchase a second home, or build a portfolio, and rent their properties out to tenants.

Elsewhere in the Upad Landlord Hub and in the Upad Blog we discuss the implications of these changes and how the Government continues to use landlords as a political football for headlines, when ultimately it’s tenants who end up out of pocket as a result of these initiatives.

In this guide, we're going to look at both the means of financing a purchase of a buy-to-let property, and also at how you can go about choosing the right type of property to let.

You as a Buy-to-Let Landlord

Every landlord is different. Don't feel like you need to conform to what you or someone else feels is the model of a good buy-to-let landlord. Some private landlords run their portfolio as a full-time job and take all their income from their properties. Others will simply own a property, go to work, and use a fully managed lettings solution to ensure the rent is paid, the property is kept in good condition, and that their tenants are looked after and happy.

Whether you're about to become an 'accidental landlord' and are looking at changing your residential mortgage to a buy-to-let mortgage, or have put together a business plan with the aim of building a property portfolio, we hope you find this guide useful.

Please note this article is intended as a guide only, and we recommend you seek independent advice based on your own circumstances prior to making decisions around purchasing property and committing to a mortgage.

How Will I Pay for the Property?

When buying a property there's a handful of areas that you need to give consideration to. We’ve broken each of these down below to help you understand each element at a time.

Additional Costs on Top of the Purchase Price

In addition to paying the deposit on your property, you will incur additional costs during the purchase process and in getting set up to rent out your property.

Keep the following in mind:

- Spending between £1,500 and £2,500 in lawyer and mortgage lender fees is common.

- Stamp duty for properties purchased at £125,000 or higher. The stamp duty rate varies depending on the value of the property. We recommend reading our landlord guide to the latest stamp duty rules. If you're a couple about to move in together and rent out one of your properties, or you're about to become an accidental landlord by other means, you should also read what the love tax may mean for you if you will be remortgaging.

- A consideration of funds for decorating the property if required. You may choose not to decorate or do any work to the property but remember this may mean tenants calling you quicker to fix issues. It may also make it more difficult for you to make deductions to the tenant's deposit when they leave if they haven't moved into a property in close to mint condition.

- From a legal perspective before you rent out the property, at the very least you will need to pay for a gas safety inspection and the preparation of an Energy Performance Certificate (EPC).

What are My Legal Obligations as a Private Landlord? (England and Wales)

What are My Legal Obligations as a Private Landlord? (Scotland)

In addition to these legal obligations, there are also additional requirements for HMO landlords. You should also check with your local authority whether you need to be registered as a private landlord before advertising property for rent.

Getting and Finding a Buy-to-Let Mortgage

Getting a buy-to-let mortgage isn't always easy. While different lenders will offer different terms, in general you should expect to meet the following requirements in order to get a buy-to-let mortgage:

- The rent you're going to charge on the property should be at least 125% of the mortgage repayment. Therefore, if your mortgage repayment is £800 per month, the monthly rent would need to be at least £1,000.

- Be looking to borrow at most 60% - 75% of the value of the property.

- Be able to pay a deposit of at least 25%, though the larger the deposit you're able to pay, the lower the borrowing, which in turn will save you money in interest and repayments, and may enable you to unlock a better buy-to-let mortgage deal.

We recommend you do your research. One useful thing to do is to go and see a buy-to-let mortgage broker who can talk you through a range of scenarios and options. If you're unsure whether you can afford to buy a property to let, you'll get a better idea of what you can afford. And if you're sitting on a significant cash sum you can discuss whether to pay a larger deposit on a property, or perhaps even buy two properties.

Once you're happy that you'll be able to get a buy-to-let mortgage (if you need one – if you're sitting on enough liquidity to buy a property outright then fantastic), it's time to find one.

In addition to the bullet points above, you should consider the following:

- Mortgage lenders will take additional income into account on top of rental income. If you are planning on leaving your job to be a full-time landlord in the near future, you should discuss this with each lender you speak to.

- Buy-to-let mortgages represent a higher risk to lenders in most cases, because you're reliant on the rent being paid to cover the mortgage. This means a buy-to-let mortgage may be more expensive than a residential mortgage. You may be able to reduce your mortgage rate and get a better deal by taking out rent guarantee insurance. Give some thought to your letting strategy at this point, as many rent guarantee insurance providers will ask you not to let out your property to benefits recipients, which potentially closes off a huge chunk of the private rental marketplace.

- Buy-to-let mortgages are often interest only mortgages. This is great in that you can often benefit from lower repayments, but at the same time you need to ensure you are able to buy the property outright at some stage so that you may benefit from the capital value increase.

Ensuring You Get the Best Buy-to-Let Mortgage Deal

Speak to a buy-to-let mortgage broker, see what they can help you to access, and do your own shopping around. While the numbers and percentages we've mentioned here are generally true across lenders, there may well be variations that mean a great mortgage deal is available with one lender while another is best avoided. It is also worth asking what fees can be absorbed into the repayments; this may help you keep your upfront fees down.

Take the time to compare and choose the best deal for you.

Choosing the Right Property to Buy as an Investment

Now that we have covered what you need to consider and do in order to get the best buy-to-let mortgage deal for your circumstances, we can look at how you can go about choosing the right property to buy as an investment.

What's in it for You?

Your first consideration is what you're looking to get out of your investment.

- Do you want a high rental yield?

- Or do you want a house that will provide a high level of capital growth?

Often these are discussed as a choice between short-term investing (targeting higher yields) vs. medium to long-term investing (targeting higher capital growth) but this isn't always an exact science.

Upad Asks Landlords: What's Your Minimum Rental Yield?

Top Tips for Market Busting Rental Yields

5 Ways to Boost Your Rental Yield

Why Can't I Target Both a High Yield and a High Level of Capital Growth?

You can, many landlords do, and we certainly recommend that you should. However, you're far more likely to get “a little of both” rather than be able to make exceptional yields and then profit from significant capital growth years down the line.

Why is this the case? For one, properties with potential for high capital growth are usually in desirable areas and are highly sought after. In turn, this pushes up the price of the property on day one. This means that as a landlord you would need to raise a larger deposit and make higher mortgage repayments, amongst covering other costs, all of which will cut into your overall rental yield.

Ultimately, it's a tradeoff for you as a landlord. What we don't know is whether in the long-term, property prices will drop or what political exercise the UK Government will embark on next that does nothing but influence rent levels. Whether you sit down with a financial advisor or do your own calculations, decide what level of risk you're comfortable with and what you want to get out of your buy-to-let investment.

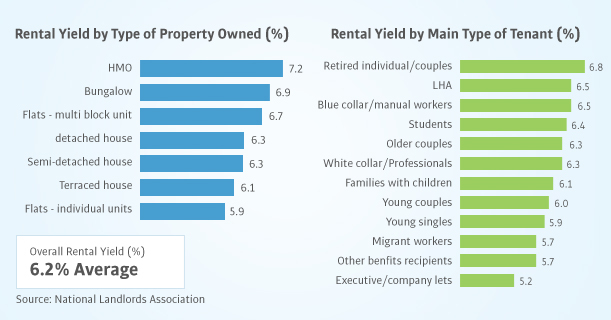

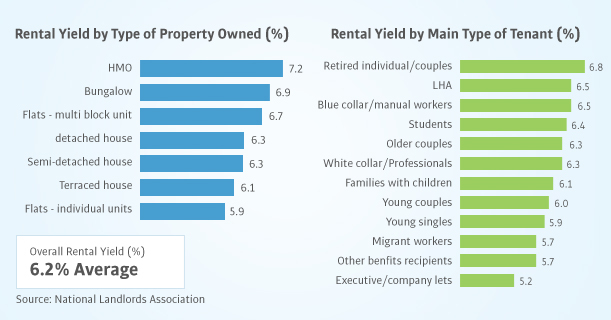

Aligning Rental Yield to Tenant Behaviour

What we're trying to say here is that if you decide to chase rental yield, you still need to weigh up what each type of tenant will bring to your property.

As we can see, HMO's provide the highest yield, which may make you think a student house is worth buying. However, if the house isn't in a terrace or general area with other student houses, if they decide to party all night you'll quickly end up dealing with unhappy neighbours. On the flipside, we do know that a very low number of landlord insurance claims come from student properties, and while you'll need to find new tenants every year and may have regular void periods, at least you know you'll always have a steady flow of potential tenants.

Likewise, you may decide to opt for a lower rental yield but rent out to a family, who are likely to stay for many years and allow your capital value to grow.

Choose the demographic you're looking to advertise your property to based on what you're looking to get out of your investment, then start thinking about where and what type of property to buy.

Where and What?

As a new landlord we recommend you do everything you can to ensure your property type and location is tailored as closely as possible to what your target market would want.

It's not too difficult to marry up what different types of tenants need, but surprisingly some landlords don't take this into consideration and as such struggle to let their properties and put their investment at risk.

- Properties near universities are your prime market for HMO's with students. Travel to the area yourself and it'll usually be easy to spot where the streets containing predominantly student housing are.

- Professionals both young and a little older may be suitable for a house or a flat, but they'll predominantly be thinking of their commute, which means being able to offer parking and a home that enjoys excellent transport links, plus options for fast food or a supermarket for picking up dinner close to the doorstep after a long day.

- Families will also be looking for transport links but will also be considerate of schools, the size of the garden, and suitable nearby amenities.

These are just three examples, but you should visualize exactly who you want to let to, and then find a property accordingly.

Should I Buy Close to My Own Home?

If you're planning on self-managing your property, then over the years you'll save yourself a small fortune on fuel costs if you do rent out a home close to your own, but at the same time there may not be the rental demand in your area to justify the investment.

While more than half of all private landlords buy properties within 10 miles of their own home, that doesn't mean it's right for you. For example, if you commute to work 25 – 30 miles away and there are potential high yield properties in that area, that could be equally as convenient for the self-managing landlord.

To help you make your decision, consider the following:

- Can you afford to buy another property close to where you currently live?

- Are there properties nearby that can deliver what you're looking for in terms of rental yield and/or capital growth?

- What financial and time cost is attached if you choose to buy and self-manage a rental property that isn't close to you, your place of work, or another location you travel to regularly, such as a family member's home?

Undertaking Additional Research

The questions you've asked yourself about whether you should buy a property close by can also form the basis of your additional research, wherever you ultimately decide to buy:

- Can you afford to buy in that area?

- What is the competition like in the area for rental properties? Would your mortgage deal mean the rent would have to be significantly higher than the average in that area, therefore making your rental less attractive?

- Is the average rent level enough that healthy rental yields are achievable and worthwhile, and aligned with what you want to make?

Once you know this you can either start looking for a property to buy, or dig into even deeper detail. Look on the property portals at the properties in your area, at the price you want to rent at, and look for:

- Which properties were let the quickest?

- Trends in the types of properties. Were student houses significantly more popular than student flats, for example?

- Is a specific street or neighbourhood performing better or worse than the rest of the area? Why? And what does this tell you about whether you want to buy a property or avoid buying here?

- What did the properties that let quickest have in common? Were they all small flats? Did they all have a garden? Did they have a garage or offer other secure parking?

By asking these questions and doing additional research you will be able to narrow down your buying opportunities to a very specific selection of properties, which will then allow you to spend your time wisely looking only at properties you're potentially going to buy.

The Holy Grail…Picking Up Property on the Cheap

Picking up a bargain really is the holy grail for many property investors. We'd all love to find a property to buy way below the average cost of other properties of the same type, spend a few thousand pounds on repair work, rent it out to tenants and then eventually sell for somewhere close, maybe even above, the average market value.

It isn't easy, though, but if you stay on your toes as a landlord, especially if becoming a full-time landlord is a long-term part of your thinking, there are opportunities to be taken advantage of.

Opportunity 1: Buying Close to Expensive Areas

Let's say Town A is hugely popular and property prices are high and growing at above the average rate. Town B borders Town A but isn't currently as expensive. In the long-term, it is likely that as demand grows for Town A, people will then start looking at Town B if they cannot buy in Town A, either due to lack of availability or the demand driving the price too high. You could then sell your property in Town B, not at the price of a property in Town A, but at a considerable profit all the same.

A smart landlord can use the mechanics of supply and demand to their advantage to maximise their capital gains.

Remember this opportunity won't always present itself, but it's worth being able to act quickly if it does.

Opportunity 2: Keep an Eye on Redevelopments

By being clued up on local news across various regions, you can quickly find out when money is being put towards public space redevelopment initiatives, or when new warehouses, offices, or retail parks are going to be built. All of these can drive a demand for housing in the local area as they have the potential to create thousands of jobs. Could your next buy-to-let property be the perfect rental for someone coming to work nearby?

Opportunity 3: Property Auctions

Property auctions are fantastic opportunity to add to your portfolio if you have liquidity. Why do you need liquidity? Because with most property auctioneers you need to pay 10% of the sale value on the day of the auction and the final balance within four weeks. As a new landlord this may not be one for you now, but could well be something you are able to take advantage of in the future.

Remember to be wary of auctions, however. You won't turn up and be guaranteed to buy a house for 40% of its market value, but given the volume of auctions due to repossessions, and property investors looking to quickly move assets either to cut their losses or generate cash flow, they represent a great opportunity if you're patient and know what to look for.

Don't just turn up to property auctions, either. Find out when viewings are taking place on the properties to be auctioned so you can take a look around and know what you're buying.

How Do Upad Landlords Do It?

In addition to reading and bookmarking this guide, we also recommend you take the time to see what Upad landlords said when we asked them how they choose their buy-to-let investments.

How do You Choose the Right Buy-to-Let Investment?

The Beginner's Guide to Buy-to-Let

You now know everything you need to know to start thinking about becoming a buy-to-let landlord! Why not register with Upad now to get started, enjoy our other landlord guides and resources, and put yourself on the path to a profitable rental or property portfolio.